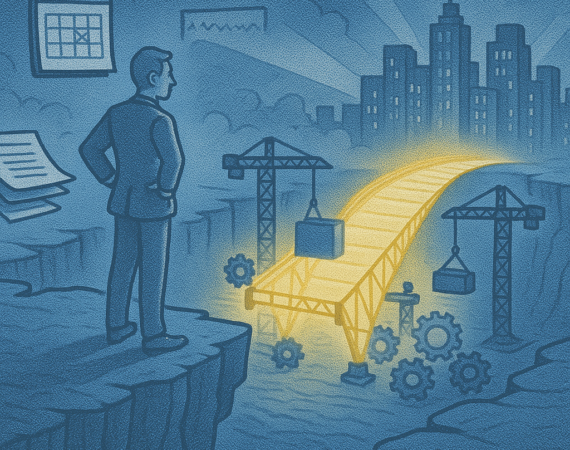

When a client's loan matured with no refinance in sight, Edgewater Lending delivered a fast, flexible bridge loan that avoided foreclosure, stabilized the asset, and allowed for a full-value sale on the borrower’s terms.

Market Insights: Where Distressed Property Activity Is Picking Up

Loan maturities and tighter credit are driving distress in commercial real estate, especially in Sunbelt cities, urban office markets, and secondary retail corridors—Edgewater Lending helps borrowers and advisors navigate this pressure with strategic bridge and exit financing.

Case Study: How One Florida Developer Got Out of Bankruptcy with a Customized Loan Solution

When a South Florida developer faced bankruptcy and foreclosure, Edgewater Lending provided a fast, customized bridge loan that preserved the project, satisfied creditors, and enabled a successful exit—all within 13 business days.

DIP 101 for Legal Advisors: When to Consider Debtor-in-Possession Financing

DIP financing can be the lifeline during Chapter 11, giving clients the capital they need to reorganize, avoid liquidation, and stay on track—especially when traditional lenders step back.

Distressed Property Roundup: Trends, Risks, and Financing Solutions in Today’s Real Estate Market

Real estate distress is rising—not from poor performance, but from loan maturities and limited refinancing options—prompting a wave of bankruptcies and foreclosures; Edgewater Lending helps fill the financing gap with tailored bridge and rescue capital solutions.

Case Study: How Edgewater Lending Helped a Borrower Exit Chapter 11 with a Quick-Close Bridge Loan

If your lender won’t renew or refinance, Edgewater Lending’s bridge financing offers fast, flexible solutions to help you stay in control.